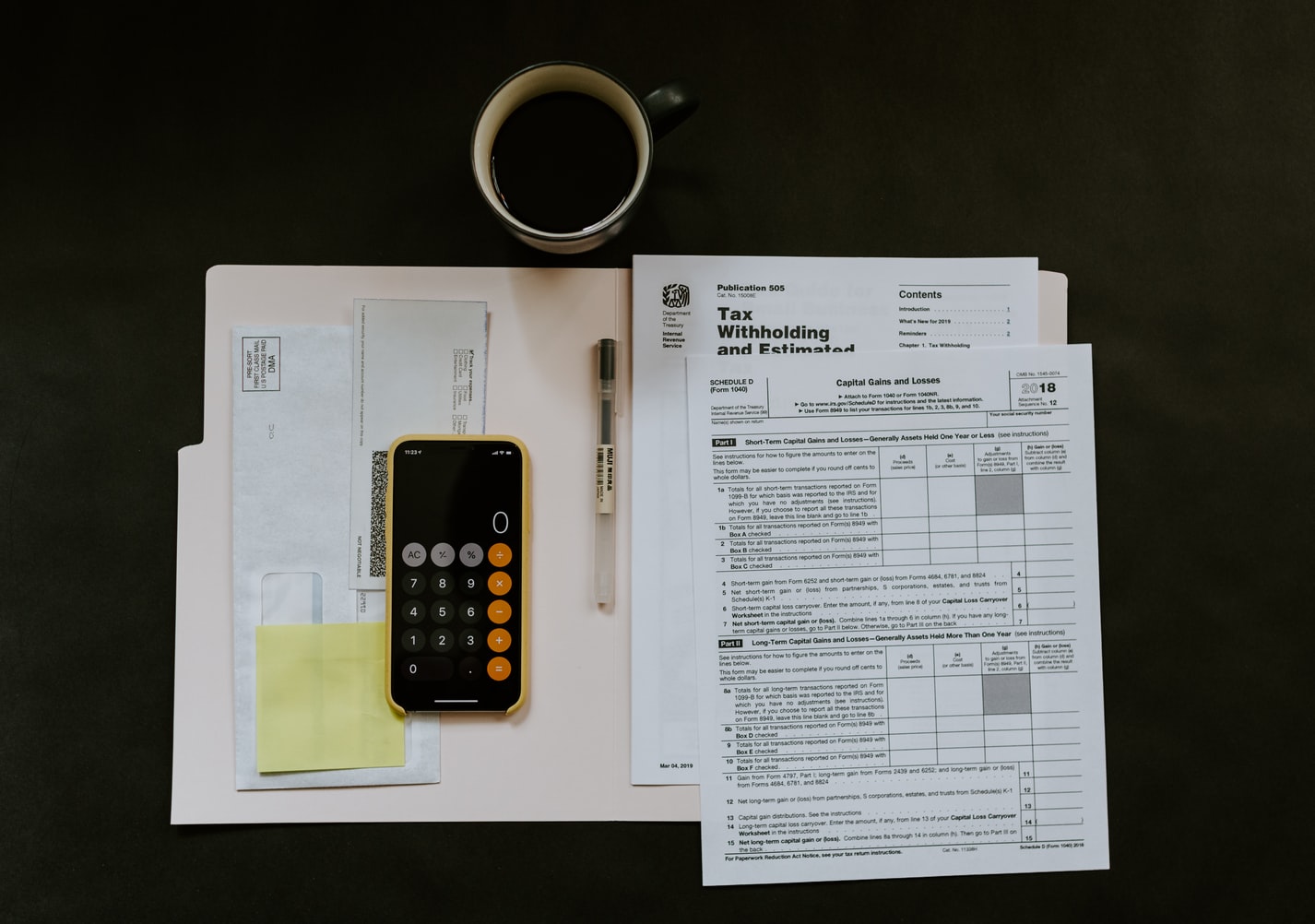

It’s certainly safe to assume that your house is barely under control during the least stressful periods of the year, but when tax season arrives, you’ve probably given up on organization completely.

Every horizontal surface in your home becomes covered in yellowed receipts, and every filing cabinet and desk drawer is upended in frantic hunts for W2s and expense reports in the hectic race to find essential tax information. At best, you’ll have to eat for a few weeks on the couch; at worst, you’ll completely forget to eat during the pandemonium.

Identity theft can be reduced by keeping tax paperwork orderly and securely stored. And if you get organized now, you’ll be thankful when you don’t have to spend hours next year looking for receipts and other paperwork.

Here are four tips for staying organized throughout tax season.

To file tax documents, use an accordion folder

It was a stroll in the park the first time you submitted a tax return. You most likely just have one W-2 from a high school job to record. Am I correct?

When you reach adulthood, you may receive a stack of W-2s and 1099s for just one year. That’s not even taking into account additional tax forms from your assets, mortgage, rental property revenue, and so on.

Get an accordion folder and write the year on each part (ex: 2015, 2016, etc.) Then, in the appropriate folder, place your previous tax returns. When tax forms arrive in the mail, place them in the current year’s compartment.

Include a copy of your return in that folder once your taxes have been submitted. That way, if you need to refer to previous tax forms, you may do it fast.

Putting tax preparation on your calendar not only mentally prepares you for the chore ahead, but it also ensures you’ll have the time to do it. That’s a lot better option than waiting until the last minute and cramming the task into an already overburdened schedule.

Keep in mind that the advice above is only for individuals who do their own taxes. If you work with or prefer to have your taxes prepared by a skilled tax preparer, call or contact as soon as possible to set up an appointment. You’ll be glad you put in the effort. Unless you will need to have some self-directed learning skills so you can do taxes by yourself.

Maintain a Charitable Donation Tracking Spreadsheet

You must have proof of your charitable gifts in order to claim a tax deduction for them. Either a bank record or an official notice from the charity verifying the amount and date of your contribution is required.

If you give frequently, keep a spreadsheet with the date, amount given, and charity to whom you gave in case you need to request formal evidence. This way, you won’t have to rush at the end of the year to meet the deduction’s requirements.

Many people keep their paperwork in a random desk drawer at work. Tax documents are valuable and confidential. Consider investing in a secure filing cabinet to keep vital tax documents and personal information such as passports safe. You may also require the purchase of a paper shredder. Keep in mind that bank paperwork, tax records, and other sensitive data should always be disposed of with care.

Receipts should be scanned and saved

Every year, a few receipts go missing. It never fails to amaze me. You have a lot of receipts if you run a business or charge expenses for work that isn’t reimbursed. A receipt scanner can save your life.

You won’t have to look for long-lost receipts, and once scanned, they may be filed away by tax deduction on your computer, making your life much easier.

Best of all, you may deduct the receipt scanner from your taxes next year as an office expense. Don’t want to spend the money on a receipt scanner? Instead, use an accordion pocket folder for checks or coupons. It’s about the same size as the other and will keep all of your receipts in one spot.

Collecting appropriate receipts now will save you problems and difficulties later on. Find a manila folder, an empty shoebox, or a document box to store your documents in. All of your receipts will be kept in just one container. Estimates, invoices, and receipts can all be generated using invoice generators or other online software. When examining your records or filing your taxes, this will save you time.

Next, empty your handbag or wallet of all receipts and place them in the box. When you’re done with that, go through your house or office looking for receipts. Look in drawers, on top of countertops for desks, in stacks of documents, and other places. Take whatever you come across and put it in your receipt box.

Documents You Don’t Need to Shred

Finally, every household should have a paper shredder so that you can securely dispose of tax papers that are no longer needed after consulting applicable IRS look back periods.

Tax documents aren’t the only documents that should be shredded before being thrown away; outdated bank statements, spam credit card offers, and mail containing personal information should all be shredded as well.

While these processes may appear to be inconvenient, consider the advantages of gathering your materials and not stressing over missed deadlines. Consider the tax refund you’re due as a result of your hard work.

Organizing your taxes should be a lot easier now that you’ve read these ideas.